Common FAQ

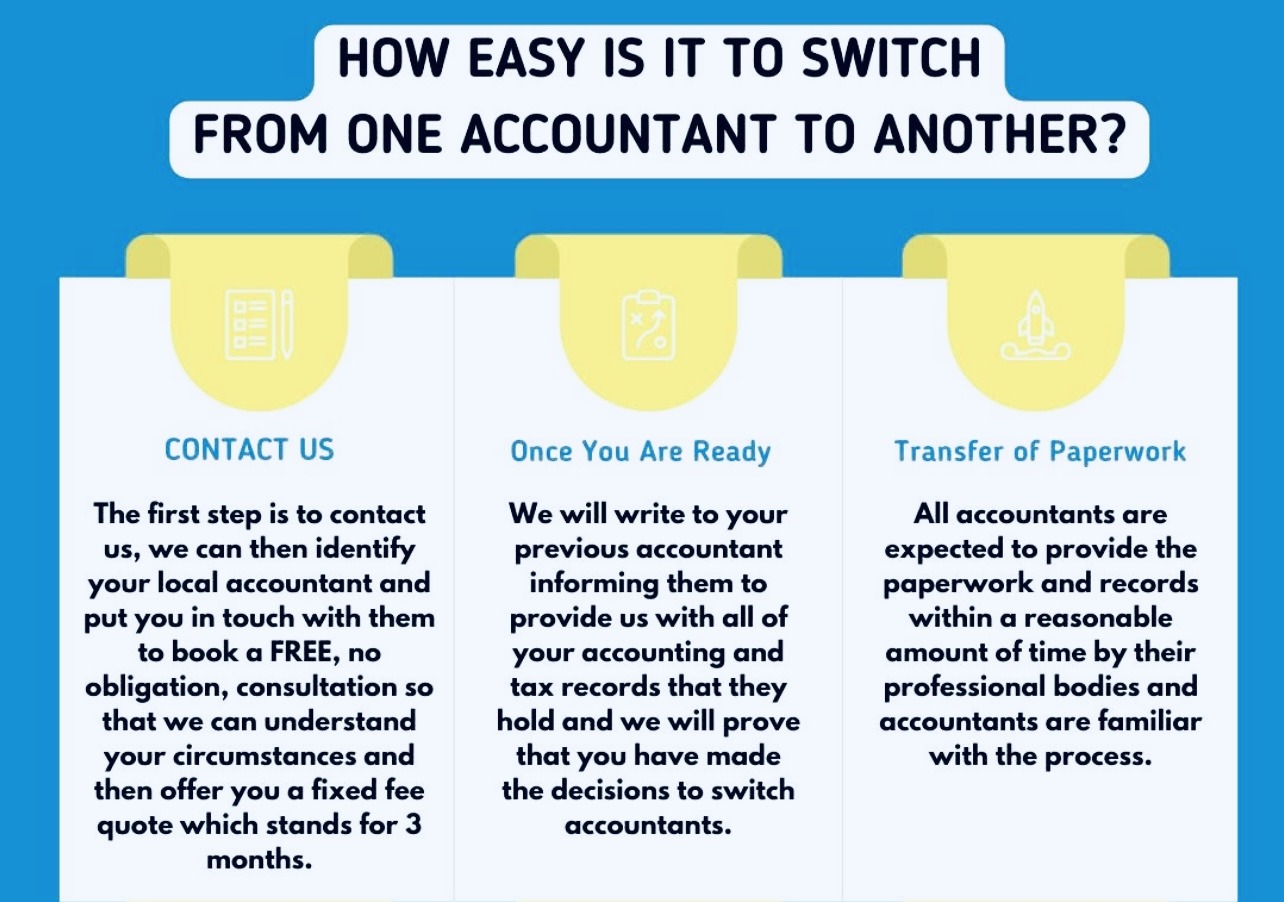

MH Consultants provides a full range of accounting services, including bookkeeping, payroll management, tax preparation, financial reporting, and compliance. We cater to businesses of all sizes, offering customized solutions to meet unique financial needs. Whether you need day-to-day transaction management or strategic financial planning, our experienced team is here to ensure accuracy, efficiency, and peace of mind.

We stay updated on the latest tax laws and regulations to ensure your business remains compliant. MH Consultants offers thorough tax preparation, filing, and planning services to minimize liabilities and maximize returns. Our experts review your financial records meticulously, ensuring accuracy and adherence to legal requirements, so you can avoid penalties and focus on growth.

Yes, we provide financial planning and forecasting services to help businesses achieve their long-term goals. By analyzing your financial data, identifying trends, and providing actionable insights, we assist in creating budgets and strategic plans. With MH Consultants, you’ll gain the tools to make informed decisions that drive growth and profitability.

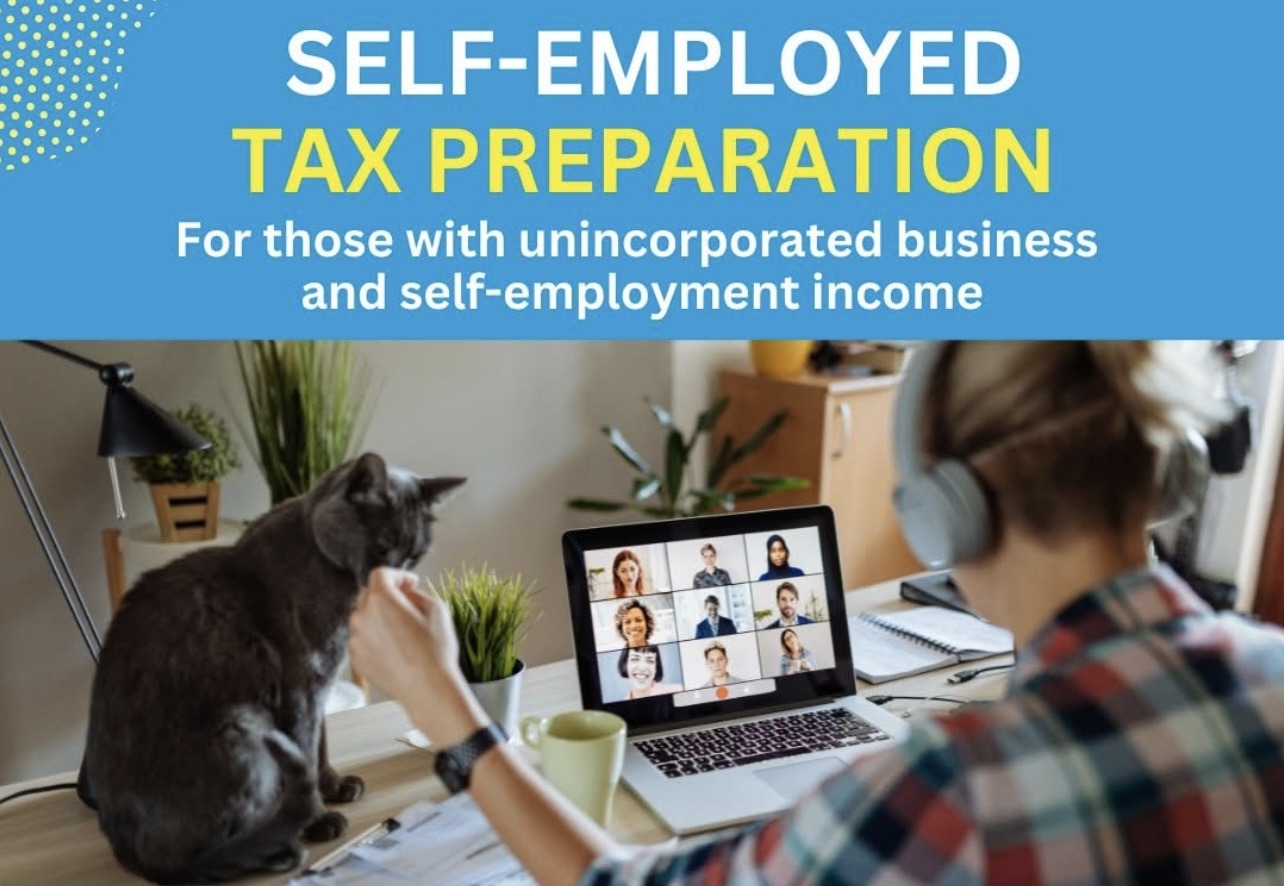

Absolutely! MH Consultants specializes in personalized accounting solutions tailored to small businesses. We understand that every business is unique, so we adapt our services to your specific needs, whether it’s bookkeeping, payroll, or tax management. Our goal is to provide cost-effective, reliable accounting support that helps your small business thrive.

We help businesses optimize cash flow by tracking income, expenses, and outstanding payments. MH Consultants provides strategies to improve liquidity, reduce costs, and enhance financial stability. With regular financial reports and expert advice, we ensure you have a clear view of your cash flow, enabling better decision-making and sustainable growth.